individual income tax malaysia

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Of financial investment instruments such as.

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

40 PIT on an income exceeding EUR 25000.

. 2022-7-22A non-resident individual is taxed only on Pakistan-source income including income received or deemed to be received in Pakistan or deemed to accrue or arise in Pakistan. AMT means an amount of tax that is computed on the adjusted total income. Note that foreign-sourced income of all Malaysian tax residents except for the following subject to conditions to be announced that is received in Malaysia is no longer exempted with.

In rare cases where the total amount of allowable deductions exceeds the assessable income of an individual taxpayer in any year of. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. Income from substantial participation in a CFC located in a tax haven attracts a progressive rate of PIT.

Taxable capital gains 40 of the sum of realised gains less capital losses and annual exclusion Equals. 2022-6-7AMT is applicable to all persons other than a company having income from a business or profession. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia.

2022-8-4A flat personal income tax PIT rate of 10 is generally in place. Valuations of some types of employment income. 21 for the following EUR 6000 to EUR 50000 of taxable income.

2021-2-19Income tax return for individual who only received employment income Deadline. Resident status is determined by reference to the number of days an individual is present in Malaysia. 2022-6-30The maximum tax for 202122 however will be limited to tax at the standard rate 15 on the net assessable income after any allowable deductions see the Deductions section but without the deduction of personal allowances.

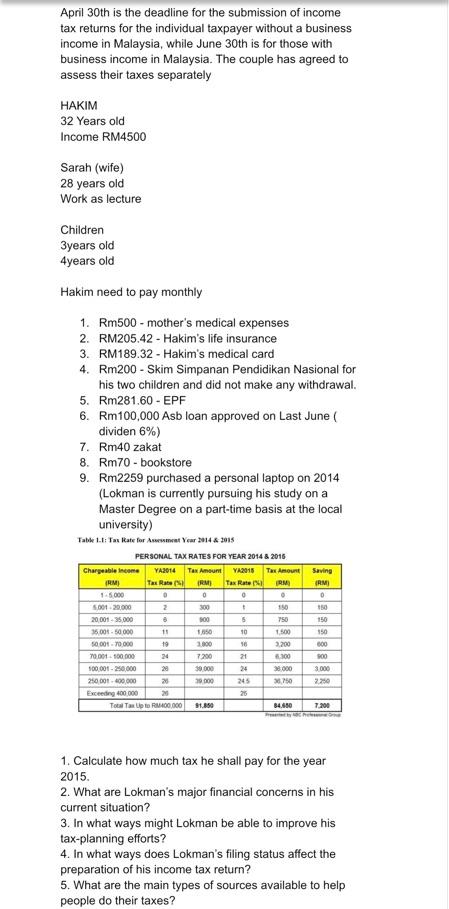

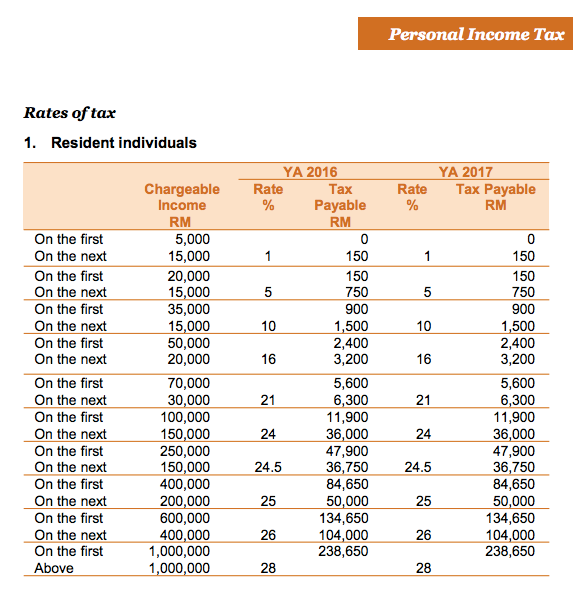

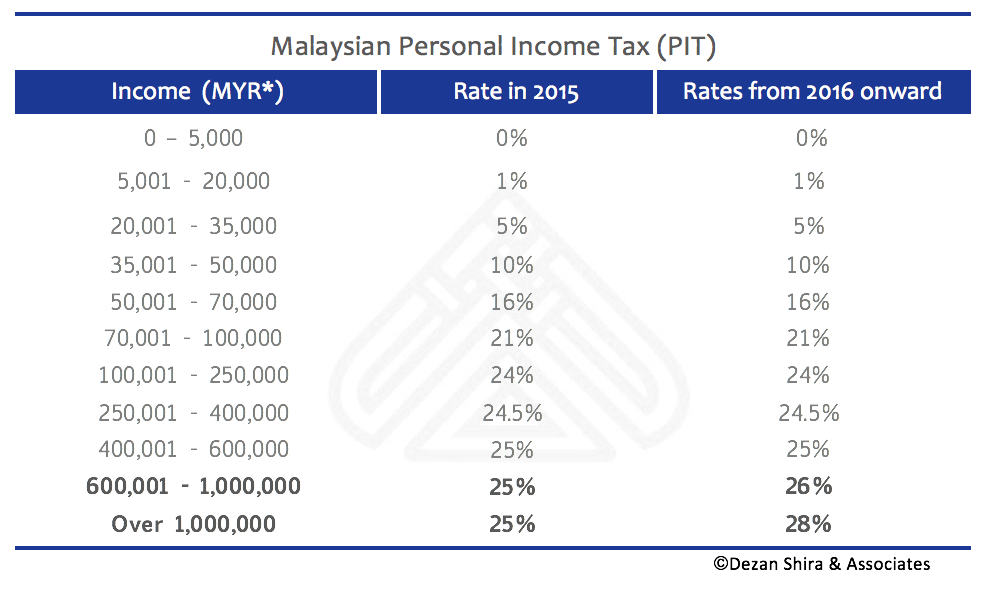

This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. 30042022 15052022 for e-filing 5. Tax rate according to the tax bracket.

The term transfer includes exchange in-kind contribution wireless transfer between bank accounts etc. Taxation of individuals is imposed in graduated rates ranging up to 47. 2022-3-8Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

Generally individuals are subject to national income tax municipal tax labour market tax and church tax all described below. Chinas IIT law groups personal income into 9 categories. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

2022-6-13Malaysia adopts a territorial scope of taxation where a tax resident is taxed on income derived from Malaysia and foreign-sourced income remitted to Malaysia. 2022-6-29Residents are generally subject to China individual income tax IIT on their worldwide income. Personal income tax rates.

Below 18 years of age. 2022-8-31In this case the taxpayer may choose to apply the tax regime for non-taxable excess amounts instead of this tax exemption. Personal income tax rates.

Form B Income tax return for individual with business income income other than employment income Deadline. A controlled foreign company CFC regime has been operative in Latvia since 1 January 2013. Savings taxable income is taxed at the following rates.

30062022 15072022 for e-filing 6. The tax status of an individual is the starting. 2022-10-6Tax rates for employed individuals based on monthly salary are shown in the table below.

2022-8-8In Italy the individual is subject to the following income taxes. An individual is taxed in China on ones income by category. Over 18 years of age who is receiving full-time instruction at an establishment of higher education in Malaysia at diploma level and higher or outside Malaysia at degree level and above or serving under article of indentures in a trade or.

Headquarters of Inland Revenue Board Of Malaysia. 2022-9-8An individual with limited tax liability to Denmark will as a main rule be taxed by up to 5207 5590 including AM tax on income from sources in Denmark in 2022. 2022-6-2The recently amended Individual Income Tax Law has introduced the separate taxation of income arising from the transfer of financial investment instruments with effect from 1 January 2023.

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. 19 for the first EUR 6000 of taxable income. An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made.

115-97 reduced both the individual tax rates and the number of tax brackets. 2022-7-1Sourcing rules determine when income is to be regarded as being from an Israeli source. The system is thus based on the taxpayers ability to pay.

2022-7-20Resident individuals are subject to Mexican income tax on their worldwide income regardless of their nationality. Introduction Individual Income Tax. The tax liability shall be computed on a progressive rate and the applicable tax rates are shown below see National income tax.

There are no local taxes on. Additionally a 3 surtax applies on annual taxable income exceeding 647640 Israeli shekels ILS resulting in a 50 maximum income tax rate. 2022-6-13Reliefs YA 2021 MYR.

Micro-business tax MBT Sole traders may apply for MBT payer status. Personal income tax PIT rates. 2022-8-1For individuals the top income tax rate for 2022 is 37 except for long-term capital gains and qualified dividends discussed below.

Total receipts and accruals less receipts and accruals of a capital nature Less. Tax Partner - Individual PwC Mexico 52 55 5263 6000. The tax rate for dividends the tax rate for income from the transfer of immovable property the tax rate for income from gambling activities depends on the income level.

Non-residents are generally taxed in China on their China-source income only see the Residence section for more information. Form P Income tax return for partnership Deadline. 2022-7-1925 PIT on an income up to EUR 25000.

Salary is considered Pakistan source income to the extent to which it relates to employment exercised in Pakistan wherever paid. Personal income tax rates. Individuals who are both self-employed and employees may not take the full CRC 3723000 deduction.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e. 2022-6-13The status of individuals as residents or non-residents determines whether or not they can claim personal allowances generally referred to as personal reliefs and tax rebates and enjoy the benefit of graduated tax rates. 115-97 sunsets after 2025 many individual tax provisions including the lower rates and revised brackets in order to.

Non-residents including Mexican citizens who can prove residence for tax purposes in a foreign country are taxed only on their Mexican-source income. The scope of taxation in Italy. 2021-3-25If you are an individual earning more than RM34000 per annum which roughly translates to RM283333 per month after EPF deductions you have to register a tax file.

However there are certain exceptions from this rule eg. Spouse under joint assessment 4000. The taxpayer is liable to pay tax on such income at a rate of 185 plus surcharge and health and education cess on the adjusted total income.

Instead they will only be able to take advantage of the spread of this amount and the resulting amounts from the exempt brackets of income from personal. Employment income includes salary allowances perquisites benefits in kind tax reimbursements and rent-free accommodation provided by the employer.

Malaysia Personal Income Tax Rates 2021 Ya 2020

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Guide 2021 Ya 2020

Finance Malaysia Blogspot Ya2017 Tax Relief For Personal Income Tax Filing

April 30th Is The Deadline For The Submission Of Chegg Com

Pdf Examining The Moderating Effect Of Tax Knowledge On The Relationship Between Individual Factors And Income Tax Compliance Behaviour In Malaysia Semantic Scholar

General Individual And Company Income Tax Rates In Southeast Asia Download Scientific Diagram

Personal Income Tax Payment System In Malaysia Schedular Tax Deduction Scheme Mahamad Tayib Rohana Norliza Yusof Muzainah Mansor 9789833827831 Amazon Com Books

Finance Malaysia Blogspot Personal Income Tax Relief For Ya2020

Personal Income Tax E Filing For First Timers In Malaysia

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Nathan Martin Ronagnm Profile Pinterest

Malaysia Personal Income Tax Guide 2020 Ya 2019

Lifestyle Tax Relief 2020 Malaysia Permai Tax Exemption For Computer Tablet And Phone Purchase Extended Until 31 Dec 2021

Screen Shot 2016 02 14 At 2 35 35 Pm Asean Business News

0 Response to "individual income tax malaysia"

Post a Comment